Since CFDs offer the possibility of going short as easily as long, they can be used to provide a hedge against price falls in a portfolio. For example, if you have a long-term portfolio that you wish to keep, but you feel that there is a short-term risk to the value of your investments, you could use CFDs to damage-control a short term loss by "hedging" your position. If the value of your portfolio falls, then the profit in the CFDs could offset these losses.

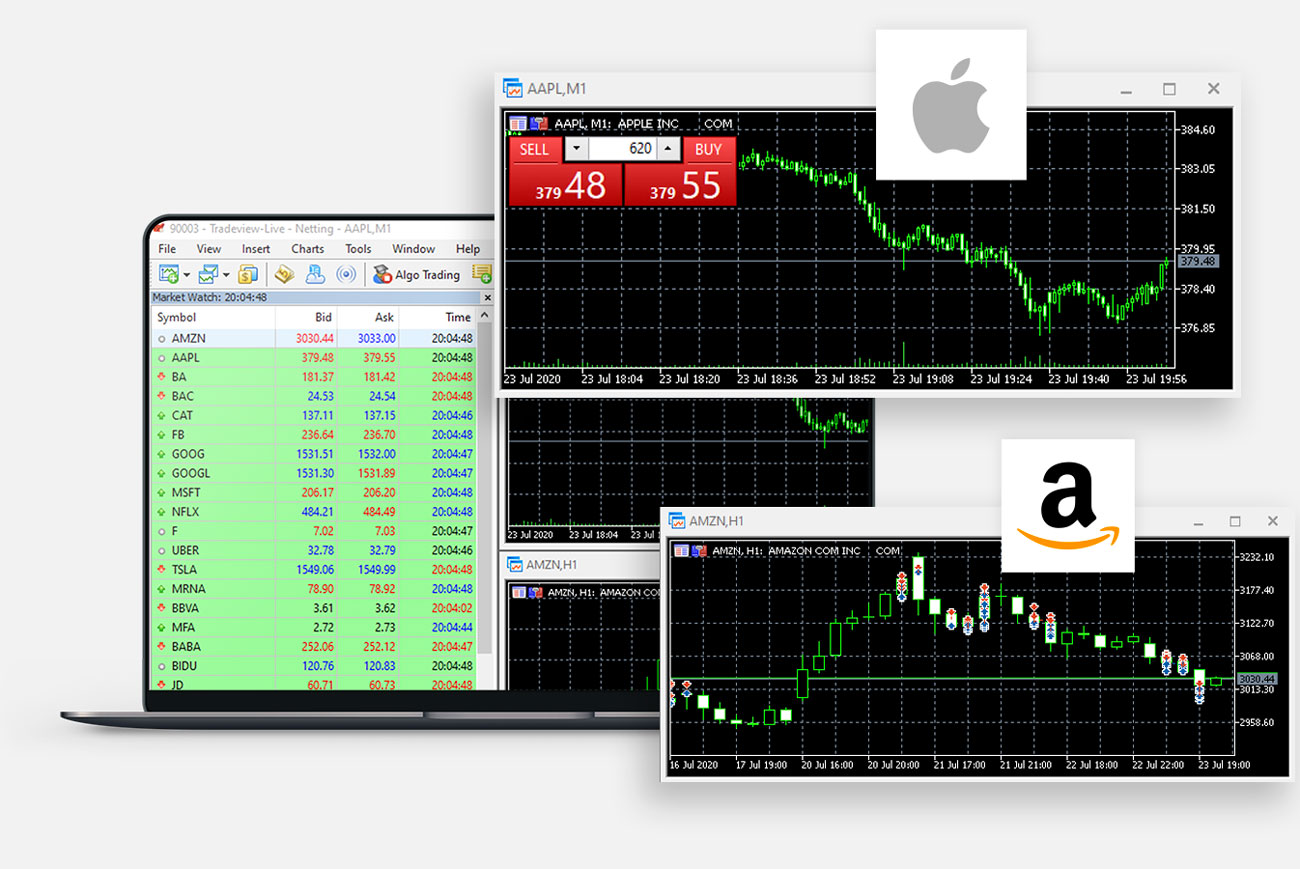

Stocks